nc sales tax on food items

Food Tax The 2 Food Tax is charged on retail sales and purchases of. Items subject to the general rate are also subject to the 225 local rate of tax that is levied by all counties in North Carolina.

To learn more see a full list of taxable and tax-exempt items in North Carolina.

. This means that depending on your location within North Carolina the total tax you pay can be significantly higher than the 475 state sales tax. We include these in their state sales. North Dakota grocery items are tax exempt.

27 This credit is available to Idaho residents. Sales Tax Collections on Food and Prepared Food In Millions 1087 1129. Currently combined sales tax rates in North Carolina range from 475 percent to 75 percent depending on the location of the sale.

The sales tax rate on food is 2. Sales taxes are not charged on services or labor. North Carolina Sales of grocery items are exempt from North Carolina state sales tax but still subject to local taxes at a uniform reduced rate of 2.

200 200 200 512 575 287 000 250 500 750 Tax at Full Rate Include All Food in State Base Include All Food in State and Local Base Local State. Counties and cities in North Carolina are allowed to charge an additional local sales tax on top of the North Carolina state sales tax. Options for Taxing Food and Prepared Food FY 2010-11.

California 1 Utah 125 and Virginia 1. B Three states levy mandatory statewide local add-on sales taxes. Select the North Carolina city from the list of.

Two levy the full rate. This page describes the taxability of food and meals in North Carolina including catering and grocery food. NCDOR Taxes Forms Sales and Use Tax.

92 out of the 100 counties in North Carolina collect a local surtax of 2. North Carolina has a 475 statewide sales tax rate but also has 459 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 222 on top of the state tax. Is there tax on take out food in NC.

On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 percent and 275 percent. 105-22890 or iii that are political committees as defined in GS. The Dare County North Carolina sales tax is 675 consisting of 475 North Carolina state sales tax and 200 Dare County local sales taxesThe local sales tax consists of a 200 county sales tax.

While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Top Are drop shipments subject to sales tax in North Carolina. A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food.

See Figure 3 Most recently Tennessee cut its sales tax on food to 4 percent from 5 percent in 2017. Under current law charitable nonprofits in North Carolina pay sales and use tax on their purchases and can apply for semi-annual refunds of the taxes they pay. Four states Hawaii Idaho Kansas and Oklahoma tax groceries at the regular sales tax rate but offer credits or rebates offsetting some of the tax for some parts of the.

Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda. To offset the cost of grocery sales taxes paid by lower-income consumers Idaho offers a grocery credit which may be claimed on a taxpayers state income tax return of 100 per individual under the age of 65 including dependents and 120 per individual for residents age 65 and older. 31 rows The state sales tax rate in North Carolina is 4750.

The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. North Carolina has recent rate changes Fri Jan 01 2021. Currently combined sales tax rates in North Carolina range from 475 percent to 75 percent depending on the location of the sale.

163-278614 and that prepare or serve food or drink for pay no more frequently than. The Dare County Sales Tax is collected by the merchant on all qualifying sales made within Dare County. Arkansas cut its rate to 0125 percent from 15 percent in 2019.

GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule. You own a grocery store in Murphy NC. 92 out of the 100 counties in North Carolina collect a local surtax of 2.

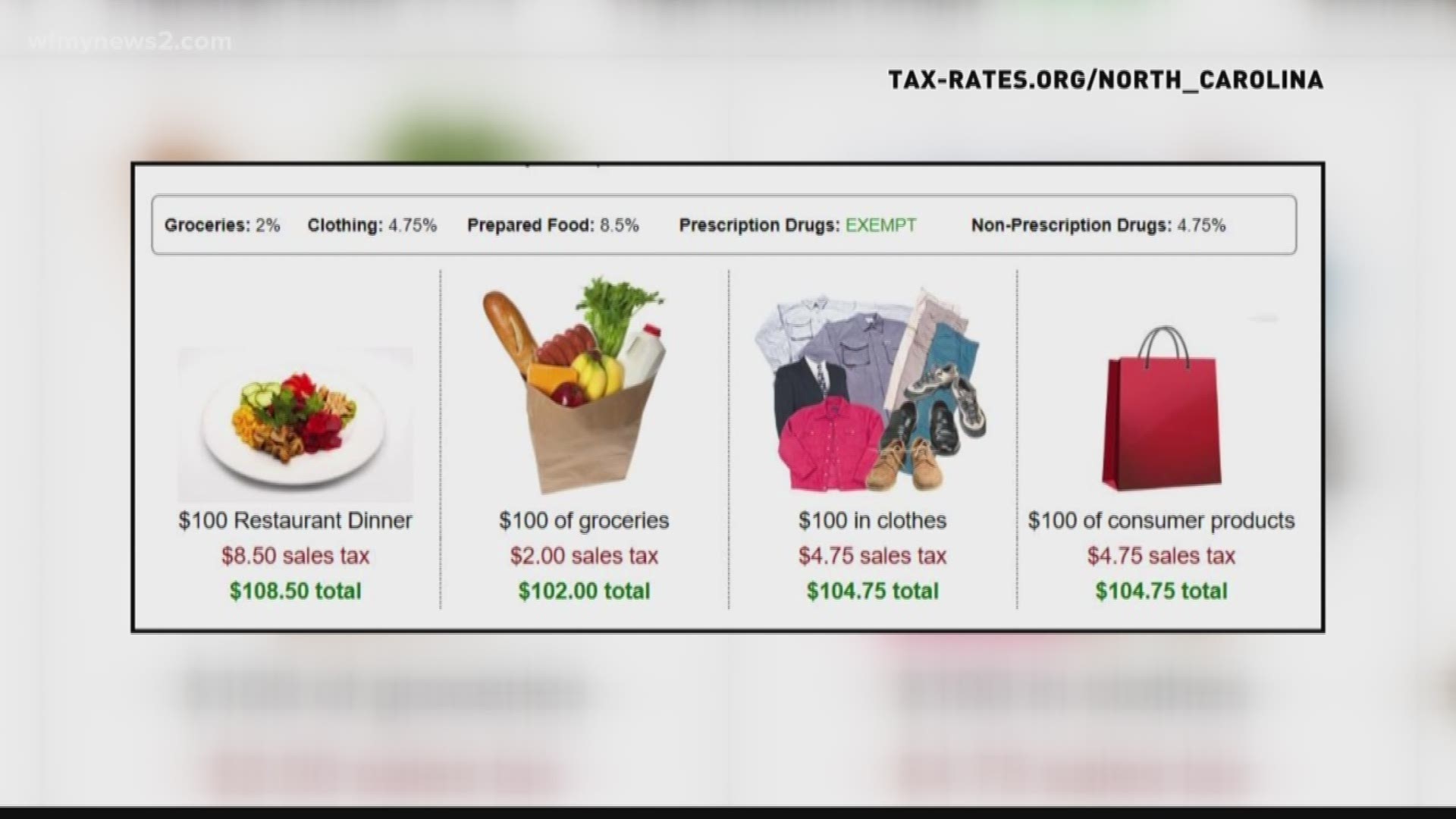

How much is tax on restaurant food in NC. The transit and other local rates do not apply to qualifying food. Candy however is generally taxed at the full combined sales tax rate.

Food Non-Qualifying Food and Prepaid Meal Plans. General Statutes or ii that are exempt for federal income tax under the Internal Revenue Code as defined in GS. Non-Qualifying Food Dietary Supplements Food Sold Through a Vending machine Prepared Food Certain Bakery Items Soft Drinks Candy.

In North Carolina grocery items are not subject to the states statewide sales tax but are subject to a uniform 2 local tax. The transit and other local rates do not apply to qualifying food. Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax.

Sales and Use Tax NCDOR. Walk-ins and appointment information. 2001 Sales tax rate on electricity sold to manufacturers that use more than 900000 megawatt-hours of electricity annually was reduced to 17 eff.

The 475 general sales rate tax plus local taxes including the transit and Article 46 sales tax are charged on purchases of non-qualifying food The reduced 2 local tax rate is charged on qualifying food which includes groceries and bakery items sold without eating utensils. A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food. Tax Treatment of Food US.

The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. Appointments are recommended and walk-ins are first come first serve. With local taxes the total sales tax rate is between 6750 and 7500.

A rate schedule was also established reducing sales tax on electricity sold to manufacturers that use more than 5000 megawatt hours annually but less than 900000 eff. A customer buys a toothbrush a bag of candy and a loaf of bread. The 475 general sales rate tax plus local tax is charged on non-qualifying food which includes prepared foods and beverages in restaurants dietary supplements food sold through vending machines bakery items sold with eating utensils soft drinks and candy.

Pin On Events At Raffaldini Vineyards

Cuisine Classique Menu And Prices Epcot 2017 Festival Of The Arts Epcot Festival Food Network Recipes

Sample Equipment Purchase Agreement Template Purchase Agreement Agreement Business Template

North Carolina Sales Tax Rates By City County 2022

Sales Tax Exemption For Farmers Carolina Farm Stewardship Association

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Sales Tax On Grocery Items Taxjar

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Is Food Taxable In North Carolina Taxjar

North Carolina Sales Tax Small Business Guide Truic

Understanding Sales Tax With Printify Printify Sales Tax Understanding Tax Exemption

Is Food Taxable In North Carolina Taxjar

Is Food Taxable In North Carolina Taxjar

Pin By Alexa On Life Hacks Poster Movie Posters Life Hacks

Is Food Taxable In North Carolina Taxjar

North Carolina Sales Tax Handbook 2022

Lessons Learned North Carolina Sales And Use Tax Lessons Learned Thrive Life Lesson