income tax rates 2022 australia

1 Salary or wages 2022. This page contains the personal income tax rates and threshods for 2022 and other associated tax tables used within the Australia salary and tax calculators on iCalculator.

Guide To Hiring Employees In Australia

39000 37c for each 1 over 120000.

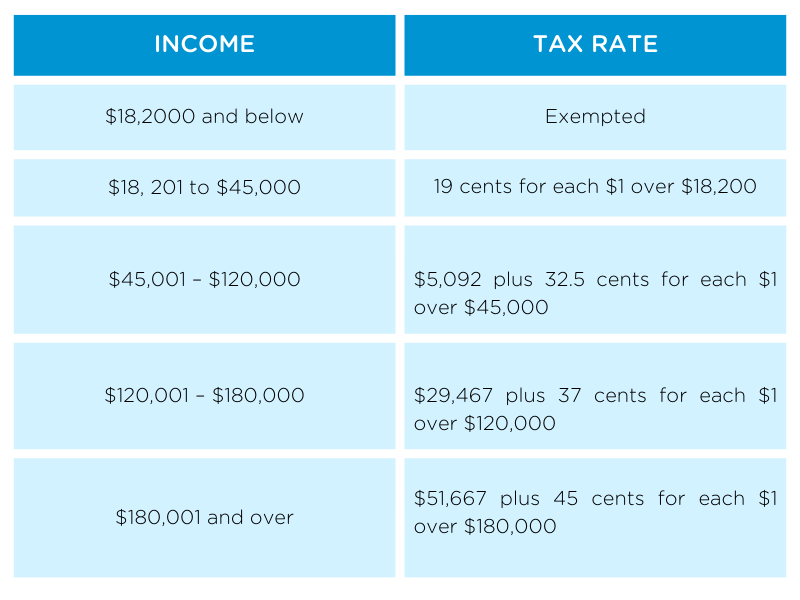

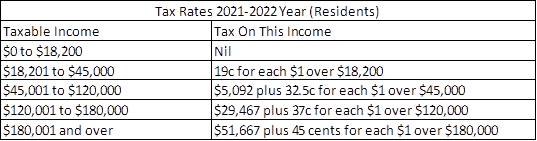

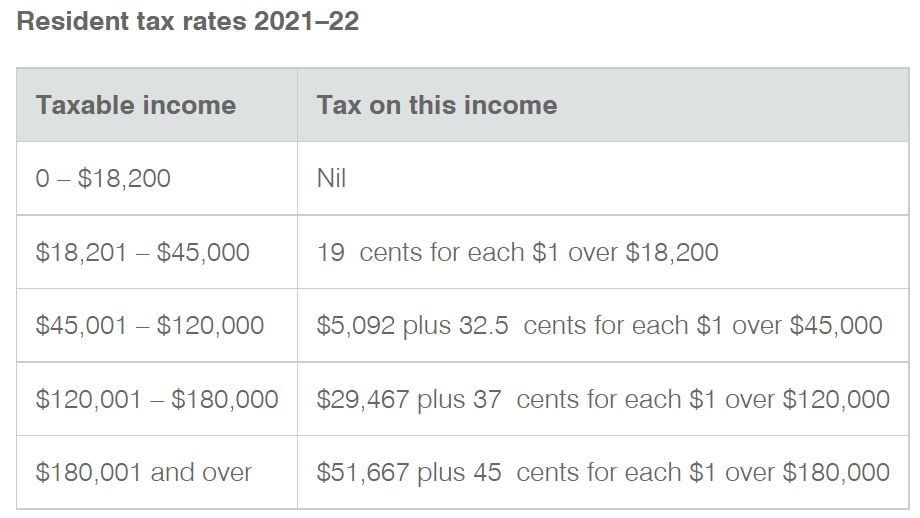

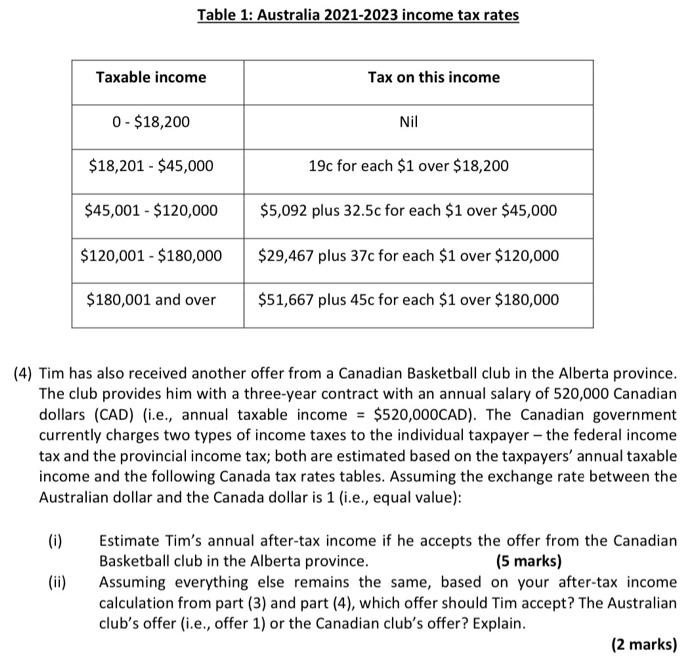

. The Personal Income Tax Rate in Australia stands at 45 percent. However for companies with an aggregate annual turnover of less than AUD 50 million that derive no more than 80 of their assessable. The income tax brackets and rates for Australian residents for this financial year and last financial year are listed below.

2 Allowances earnings tips directors fees etc 2022. PAYG withholding calculation - support weekly fortnightly. Update for FY 2021-2022.

Reflected in the above table are tax rate changes from the 2018. A resident taxpayer in Australia who earns 18200 or under in the year will pay NO tax on that income. Individual income tax for prior yearsThe.

Easy to use and accurate features include. There are no changes to most withholding schedules and tax. Tax tables for previous years are also available at Tax rates and codes.

If the annual income is 39200. The top marginal income tax rate of 37 percent will. There are seven federal income tax rates in 2022.

Income Tax in Australia 2021 2022. Australian income tax rates for 202223 residents Income. Make sure you click the apply filter or search button after entering your.

A resident individual is subject to Australian income tax on a. The Minimum wage for a Full time worker from 1 July 2022 will be 4224688 per year. The company tax rate for base rate entities has fallen from 275 to 26 in 20202021 financial year and is now down to 25 for 20212022 and later.

Australian tax brackets and rates 2022. Austria Non-Residents Income Tax Tables in 2022. 3 Employer lump sum payments 2022.

This is calculated from 52 weeks at 81244 per week being 2138 per hour for a 38. To understand how much tax you may need to pay youll first need to look at the current income tax brackets and rates as listed on. Important information July 2022 updates.

Personal Income Tax Rate in Australia averaged 4540 percent from 2003 until 2022 reaching an all time high of 47 percent. Australian income tax rates for 202223 residents Income. Tax Calculator for Financial Year 2021 to 2022.

Base rate entity company tax rates. Company taxThe company tax rates in Australia from 200102 to 202122. Tables sets out the PIT rates that currently apply to resident and non-resident individuals for the year ending 30.

You can find our most popular tax rates and codes listed here or refine your search options below. From 1 July 2022Check the fuel tax credit rates from 1 July 2022. The corporate income tax rate generally is 30.

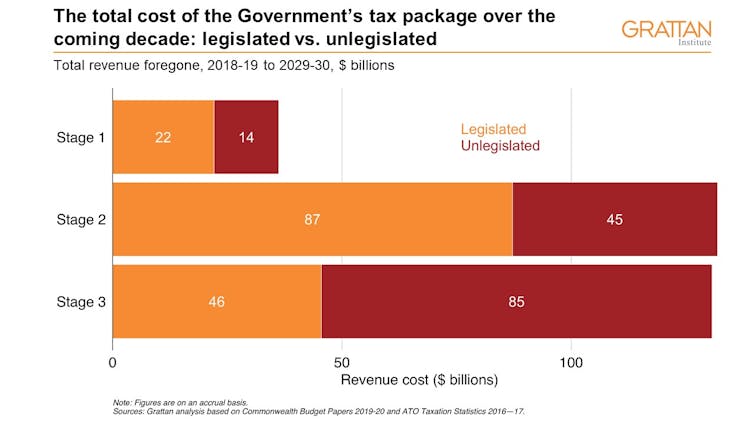

2022 Income Tax Rates Australia. Reflected in the above table are tax rate changes from the 2018 Budget for the 2 years from 1 July 2022 to 30 June 2024 which include an expansion of the 19 rate initially to. Tax rates and codes.

Income Tax Rates 2009 2010 Australia Australian Information

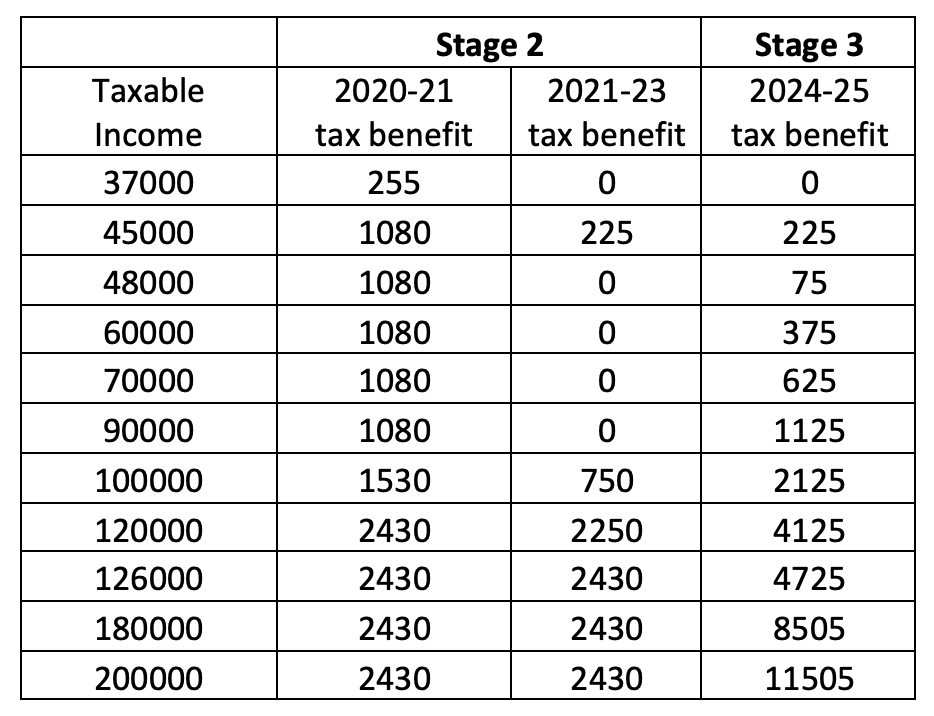

Stages 1 And 2 Should Pass Stage 3 Would Return Tax To The 1950s

Everything You Need To Know About Tax In Australia Down Under Centre

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Tax Brackets 2021 2022 Australia Canstar

Australian Income Tax Rates 2022fy

Australian Tax Calculator Excel Spreadsheet 2022 Atotaxrates Info

Capital Gains Tax Cgt Calculator For Australian Investors

How Do Us Taxes Compare Internationally Tax Policy Center

Budget Forum 2020 Progressivity And The Personal Income Tax Plan Austaxpolicy The Tax And Transfer Policy Blog

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Policy Basics Marginal And Average Tax Rates Center On Budget And Policy Priorities

Tax Rate Changes Starting Now Initiative Chartered Accountants Financial Advisers

Taxing The 1 Why The Top Tax Rate Could Be Over 80 Cepr

One Of The League S Most Prolific Scorers And Has Chegg Com

Income Tax Challenges And Smart Planning For Irrevocable Trusts 1

How The World Taxes A Guide On Tax Systems In Different Countries