pa educational improvement tax credit application

Jamie Connelly 724 513-1633. Thinkbaby sunscreen provides effective SPF 50 sun protection for babies.

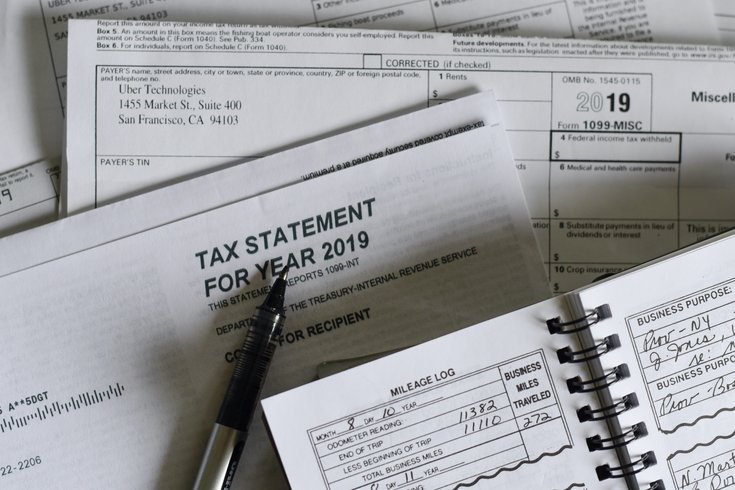

Understanding Your Tax Forms 2016 1098 Mortgage Interest Statement Mortgage Interest Student Loan Interest Credit Card Services

The total aggregate amount of all tax credits available in a fiscal year increases to 65 million from 55 million.

. 750 or above with good credit history. Throwback rules that apply under federal law do not apply under Pennsylvania personal income tax. Uses Real property improvements such as rehab expansion or physical improvements to buildings or land resulting in jobs created or retained.

447 known as the State Tax. PART 2--Child Tax Credit Sec. Do not use the Single Application.

An organization which normally receives a substantial part of its support exclusive of income received in the exercise or performance by such organization of its charitable educational or other purpose or function constituting the basis for its exemption under section 501a from the United States or any State or political subdivision thereof or from direct or indirect. Credit allowed in case of certain separated spouses. The IPAP also continues to be designated as the largest PA program in the world.

Make sure this fits by entering your model number. Refer to PA-40 Schedule OC Other Credits for additional information. Title 3 Agriculture Changes.

Universal Easy-to-add functionality to upgrade your existing garage door opener. PA Department of Community and Economic Development. Educational Improvement Tax Credit.

PART 3--Earned Income Tax Credit Sec. Smart garage control open and close your garage door from anywhere with your smartphone through the myQ App. The Educational Improvement Tax Credit EITC is available to eligible businesses that contribute to scholarship organizations including pre-kindergarten and educational improvement organizations in order to promote expanded educational.

Opportunity Scholarship Tax Credit. Those funds will be coming to municipalities soon and should match what was received in. Application of child tax credit in possessions.

An additional 5 tax credit for a total credit of 30 is available for productions that meet the minimum state filming requirements at a Qualified Production Facility. Taxpayers should write 2021 Estimated Tax Payment and the last four digits of the primary. The Educational Tax Credits program contains two sections of which credits may be awarded for applicants within the program.

At the time of this ranking. Educational Improvement Tax Credit Program EITC Opportunity Scholarship Tax Credit Program OSTC Weatherization Assistance Program WAP. The taxpayer andor spouse lives in or has a business or rental property located.

STAR in NY a veterans exemption the Massachusetts declaration of homestead etc This requirement applies to jointly held property by husband and wife even if only one applies for homestead here and the other applies for the out-of-state. Line 11 of the pro-forma PA-40 Personal Income Tax Return on PA-41 Schedule J. Educational Improvement Tax Credit Program EITC Opportunity Scholarship Tax Credit Program OSTC.

Educational Improvement Tax Credit Program EITC Opportunity Scholarship Tax Credit Program OSTC Weatherization Assistance Program WAP Community Development Block Grant CDBG Multimodal Transportation. Learn more about Careers at Drexel today. Diversity in Business Investments.

Applications for credit must be submitted on the new online application system. Quality Assurance. Beaver County Educational Trust.

The broad spectrum UVA UVB baby sunblock is suitable for daily use on infants sensitive skin offering gentle defense against the suns rays. Modification of disqualified investment income test. At least 6 months.

Drexel Universitys Department of Human Resources serves to support the Universitys most important element people. Taxpayer eligible for childless earned income credit in case of qualifying children who fail to meet certain identification requirements. PA-40 Personal Income Tax Return with the PA-41 Fiduciary Income Tax Return after the PA-41 or the REV-276 Application for Extension of Time.

At least 1 year In current organisation. The department will be able to process 2021 personal income tax estimated payments made in 2021 if taxpayers complete and mail a PA-40ES I Declaration of Estimated Tax coupon to the department along with their check for the estimated tax amount. Containing 58 per cent of the world population in 2020 the EU generated a nominal gross domestic product GDP of around US171 trillion in 2021 constituting.

Award winning educational materials like worksheets games lesson plans and activities designed to help kids succeed. The IPAP is also highly regarded among other PA programs receiving a US News and World Reports ranking of 11 out of all programs in the United States. Maintain or obtain an out-of-state residency based tax exemption reduction benefit credit etc.

Strengthening the earned income tax credit for individuals with no qualifying children. Films that qualify are eligible for a tax credit equal to 25 of the productions total Qualified Pennsylvania Production Expenses. For perspective there were 196 accredited programs in the US.

DCED Local Government Services Boards and Committees State Tax Equalization Board STEBTax Equalization Division TED Information pertaining to the STEB TED The State Tax Equalization Board STEB was initially established as an independent state administrative board by the act of June 27 1947 PL. Those PA municipalities that have applied for the First Tranche of ARPA funding will also be receiving a reallocation of funds that were left over from the ARPA program. List of Educational Improvement Organizations Effective 712015 6302016 EITC.

Overview Allows companies holding qualifying Research and Development Tax Credits to apply for approval to sell those tax credits and assign them to the buyers. Quality Assurance. Application of earned income tax credit in possessions of.

Applicants interested in applying as an Educational Improvement Organization Scholarship Organization or Pre-K Organization can apply at DCED Center for Business Financing Tax Credit Division 4th Floor Commonwealth Keystone Building 400 North Street Harrisburg PA 17120. About this item. How to Apply for RD Credit Award File an application with the Pennsylvania Department of Revenue.

Child tax credit improvements for 2021. Minimum of 21 years at the time of application Maximum of 65 years by the time of loan maturity. 2021 Personal Income Tax Forms.

Overview An incentive program that provides tax credits to businesses or private companies investing in rehabilitating expanding or improving buildings or land located within designated enterprise zones. Start for free now. The total aggregate amount of all tax credits available in a fiscal year increases to 340 million from 225 million.

Note this is NOT the Second ARPA Tranche. The European Union EU is a voluntary supranational political and economic union of 27 democratic sovereign member states with social market economies that are located primarily in Europe. The taxpayer or spouse claims any restricted credit listed on PA-40 Schedule OC Other Credits other than the Educational Improvement Tax Credit or the Opportunity Scholarship Tax Credit.

About Pennsylvania S Educational Improvement Tax Credit Eitc Whyy

Do I Pay Taxes On Workers Comp Larry Pitt

How To Dispute Credit Report Errors Credit Repair Check Credit Score Credit Repair Letters

About Pennsylvania S Educational Improvement Tax Credit Eitc Whyy

What Are 1099 Deductions With Picture Tax Forms 1099 Tax Form Irs Forms

Subsidized Amp Unsubsidized Federal Stafford Loans Student Loan Payment Loan Payoff Student Loan Debt

Eitc Explained How Pennsylvania S Educational Tax Credits Are Used Who Benefits And More Pennsylvania Capital Star

Here S How To Get The New Pennsylvania Child Care Tax Credit Phillyvoice

Chapter 13 Bankruptcy Vs Chapter 7 Bankruptcy Visual Ly Chapter 13 Bankruptcy Bankruptcy Quotes

Getting An Apartment Denial Lettering Financial Aid

Western Pennsylvania Montessori School

How Write Letter Explanation The Irs From Success Tax With Irs Response Letter Template Letter Templates Lettering Business Letter Template

Charge Off Dispute Letter Template Letter Templates Lettering Business Letter Template

Understanding Your Tax Forms 2016 1098 Mortgage Interest Statement Mortgage Interest Student Loan Interest Credit Card Services

Study Abroad Loan Or Self Finance 4 Points To Help You Choose Education Study Abroad Study

About Pennsylvania S Educational Improvement Tax Credit Eitc Whyy

Irs Owes Taxpayers More Than 1 Billion In Unclaimed Tax Refunds Tax Refund Income Tax Return Irs